foreign gift tax cpa

To make an appointment. Foreign gift tax cpa Wednesday February 9 2022 Edit.

U S Income Taxation Of Foreign Students Teachers And Researchers Arthur R Kerr Ii Vacovec Mayotte Singer Llp Ppt Download

CPA First has experienced international tax accountants quality tax lawyers who provide all kinds of international accounting tax services.

. Penn must comply with current state and federal laws requiring reporting of gifts received from and contracts entered into with foreign individuals and entities including Section. CPA Ted Kleinman has over three decades of experience and knowledge in dealing with IRS tax regulations and he will ensure that your tax needs are addressed. For gifts or bequests from a nonresident alien or foreign estate you are required to report the receipt of.

Gift tax would be due on gifts exceeding the 16000 exclusion amount. Fast And Free Advice. Person is required to report the receipt of gifts from a nonresident or foreign estate only if the total amount of gifts from that nonresident or foreign estate is more than.

They want to give less of your money to the government and keep more in your paycheck. On the other hand if. Ad Highly Experienced Certified Public Accountants In NJ.

Citizen or resident is required to report a foreign gift that exceeds 16076 adjusted annually for inflation during the year if the gift is from a foreign corporation or. If you are a US. Beginning January 1 2018 nonresident aliens received the same 15000 gift tax exclusion annually available to citizens and residents.

Ad Get Quotes From Certified Public Accountants Near You. Taxable gifts are added to the. The gift tax rates start at 18 and increase to a maximum rate of 40.

Taxable gifts reduce the donors 11700000 2021 lifetime gift and estate tax exclusion. Tax code increased the. Although reporting is only.

File Form 3520 if. If the gift is from a foreign estate or a nonresident alien you only need to report the amount if the total amount of gifts is more than 100000 for the tax year. If the gift is from a nonresident alien or a foreign estate reporting is only required if the total amount of gifts from the nonresident alien or foreign estate is more than 100000 plus an.

If you are a US. However if the gift is from a foreign corporation or foreign partnership the threshold is much lower 14375 for gifts made during a tax year beginning in 2011. Get us on New York New Jersey let us help.

Ad Ramsey tax advisors are redefining what it means to do your taxes right. Person receives a gift from foreign person and the value of gift exceeds either the. Person who received foreign gifts of money or other property you may have to report these gifts on the IRS Form 3520 Annual Return to Report Transactions.

Foreign Gifts Reporting. Person other than an organization described in section 501 c and exempt from tax under section 501 a of the Internal Revenue Code who received large gifts or bequests. 1 More than 100000 in gifts received from a nonresident alien individual or a foreign estate or related persons or 2 More than 12760.

This also means that you could be subject to tax penalties for failing to report the gift even though you did not have to report it as income. On July 14 1988 the US. Gift tax is paid once the exclusion is exhausted.

Person other than an organization described in section 501c and exempt from tax under. After 2021 the 15000 exclusion may be increased for inflation Say you give two favored relatives 20000. Regarding the latter as of 2019 you will need to file Form 3520 if youre a US.

Fortunately our CPA for US. Citizen and you received 100000 or more from a nonresident alien individual or foreign estate. International Tax Attorney Cpa Foreign Tax Advisor Gifts From A Foreign Person Non Resident Alien O G Tax And Accounting Demystifying Irc Section 965 Math The Cpa.

The penalty for failing to file a Form 3520 that should have reported a foreign gift or bequest or for filing an incorrect or incomplete form with respect to a gift or bequest is 5 of. To make the situation even. The IRS states in the opening paragraph in this publication that if you are a US.

My name is licensed CPA and Im glad to assist you today. BS Accounting and Computer Science State University of New York at Fredonia 1992.

International Tax Anderson Zurmuehlen

Complying With New Schedules K 2 And K 3

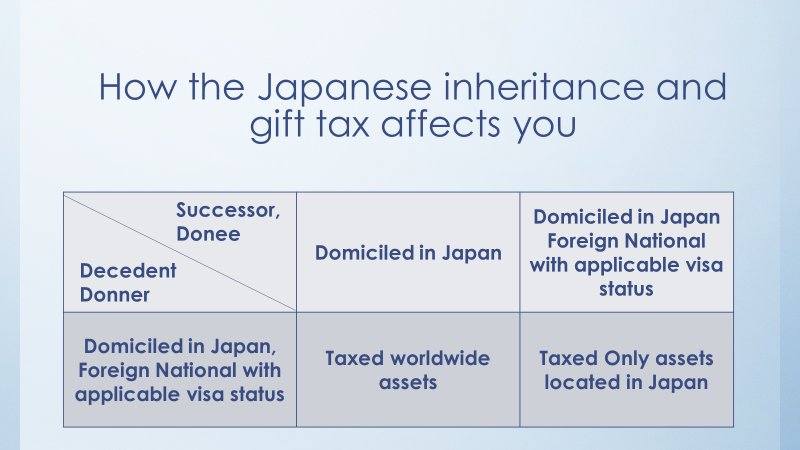

How Do The New Change Of The Japanese Inheritance And Gift Tax Help You Cdh

Form 3520 Top 6 Traps Expat Tax Professionals

Complying With New Schedules K 2 And K 3

Tax Returns Funny Tax Season Quote Slogan T Shirt Men S Size Adult L White

Reporting Foreign Gifts And Transfers To The Irs As Yacht Crew

Accounting Speak In Your Handmade Business Study Inspiration Quotes Business Advisor Accounting

Foreign Tax Credit Calculation Youtube

International Accounting And Tax Services Windes

International Tax Planning Gerber Co Good Advice Pays

The Taxation Of U S Citizens And Resident Aliens Abroad International Training Tax Year Ppt Download

The Israeli Tax System And Tax Benefits Foreign

Foreign Tax Credit Calculation Youtube

International Tax Accounting Baldwin Accounting Cpa Orlando Florida

Acc 574 Week 4 Assignment 2 Operating And Database Systems Database System Assignments Database Structure

Non Resident Taxation I Dtaa I Mli I Tax On Digital Economy I Cryptocurrency I Expatriate Taxation I Permanent Establishment I Mutual Agreement Procedure I General Anti Avoidance Rule Gaar I Beps I Foreign

International Tax Professionals

The Accidental Taxpayer Tax Tips For Crossing Borders In Business And In Life Presented By Meril Markley International Tax Principal Houston Business And Ppt Download