santa clara county property tax exemption

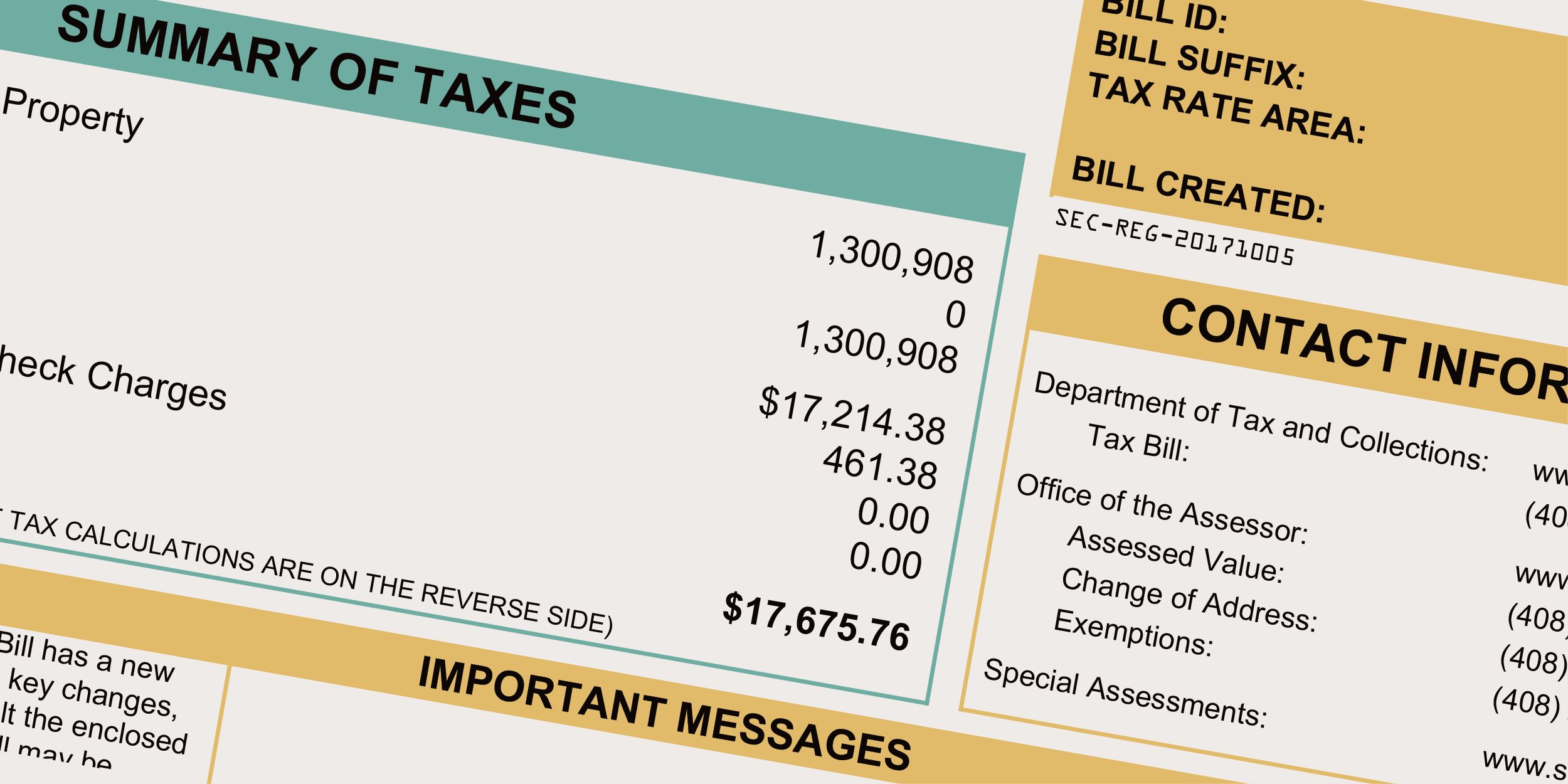

The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. Property Tax Exemptions.

Standards And Services Division

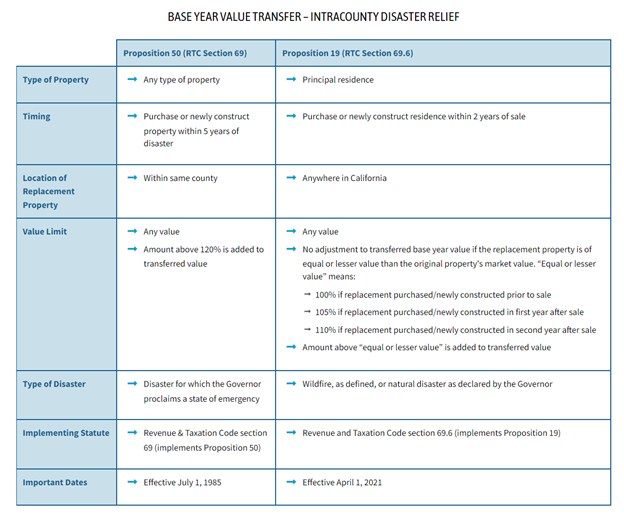

PROPOSITION 6090 ARE SUPERSEDED BY PROPOSITION 19 ON April 1 2021.

. Determine how much your real real estate tax payment will be with the increase and any tax exemptions you qualify for. Has impacted many state nexus laws and sales tax. The bills will be available online to be viewedpaid on the.

Hedding StSan Jose CA 95110-1771. Assessor Exemptions County Government Center. Learn Everything You Need to Know About School Parcel Tax Exemptions in Santa Clara County.

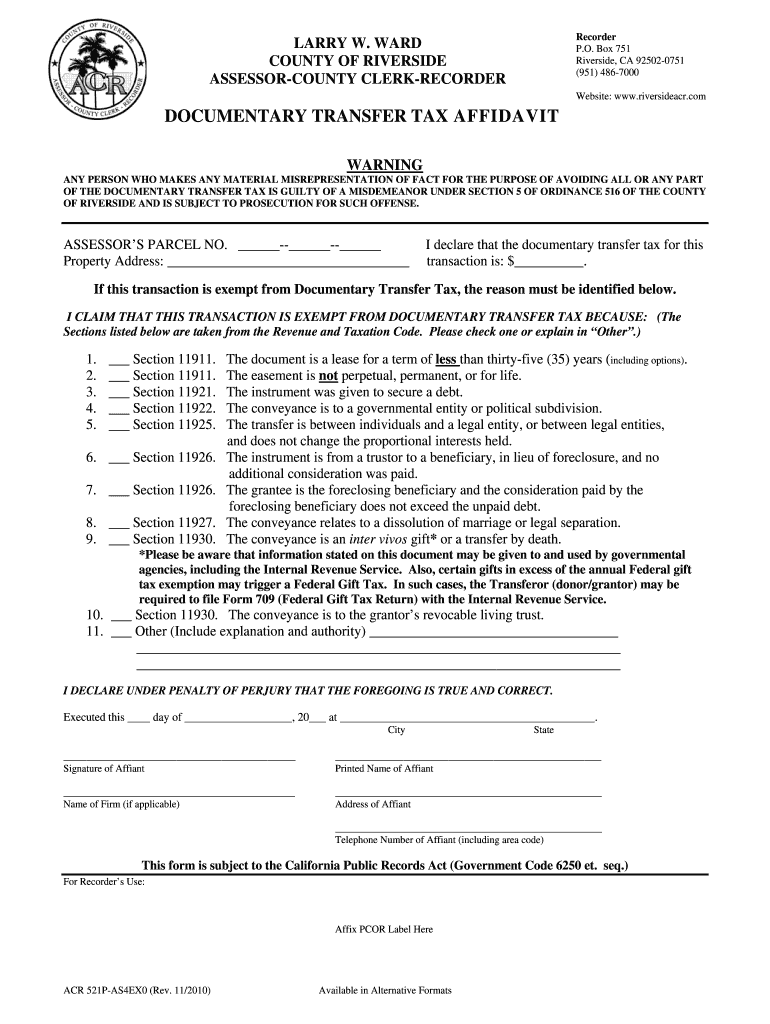

Get Access to the Largest Online Library of Legal Forms for Any State. San Jose CA 95110-1767. The 2018 United States Supreme Court decision in South Dakota v.

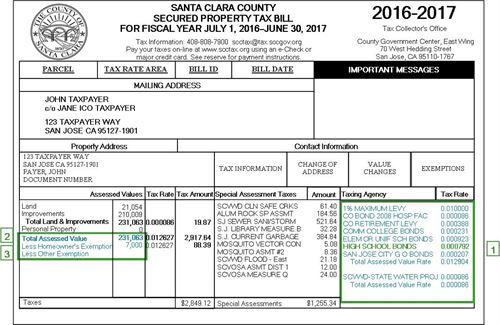

County Government Center East Wing 70 W. Business and personal property taxpayers in Santa Clara County now have access to SCC DTAC a new mobile app launched by the County of Santa Clara Department of Tax and Collections to. Use the courtesy envelope provided and return the appropriate stub.

Department of Tax and Collections. 28 rows Cambrian Exemptions Info and Application. Exemption Division - 408 299-6460.

The bills will be available online to be viewedpaid on the. Find Information On Any Santa Clara County Property. 100 disabled veterans may be eligible for an exemption of up to 150000 off the assessed value of their property.

Sunnyvale Exemptions Info and. Ad The Leading Online Publisher of National and State-specific Legal Documents. The Santa Clara County sales tax rate is.

Union Exemptions Info and Application. Applications for Property Tax Postponement for the 2020-21 tax year are now available. Parcel taxes are real property tax assessments available to cities counties.

Property Tax Rates for Santa Clara County The tax rate itself is limited to 1 of the total assessed property value in addition to any debts incurred by bonds approved by voters. The application period for the 2022 Low-Income Senior Exemption Safe Clean Water Tax is April 15 2022 - June 30 2022. This translates to annual property tax savings of.

The homeowners property tax exemption provides for a reduction of 7000 off the assessed value of an owner-occupied residence. Santa Clara County Property Tax Exemption Form - Santa Clara County Property Tax Exemption Form - How must a county exemption kind be filled in. Please call 800 952-5661 or email postponementscocagov if you prefer to have an application.

An escape assessment is a correction to a personal propertys assessed value that the Assessors Office of the County of Santa Clara did not add to any prior years Annual. The tax was renewed and approved by the voters in November 2020. Transfer of assessment to a replacement property by a property owner at least 55 years old between.

Ad Need Property Records For Properties In Santa Clara County. East Wing 6th Floor. Senior citizens and blind.

Available Exemptions Application DeadlinePeriod Renewal Website for Exemption and Application Information. Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs or to non ad. APN for real property in Santa Clara County.

Santa Clara Valley Water District. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. What appears to be a significant increase in value may only give a.

Santa Clara Mayor School District May Have Skirted State Labor Laws Campbell Ca Patch

Twitter 上的 Santa Clara County Sccgov Dept Of Tax And Collections Issues Announcement About Prepayment Of Propertytaxes Accepting Current Years S 2nd Installment Due April 10 2018 But Not Prepayment Of Future 2018 2019 Property

Stanford Wants Educational Tax Exemption For Faculty Homes News Palo Alto Online

San Mateo Santa Clara County Election Results Cupertino Today

Understanding California S Property Taxes

Grand Jury Santa Clara County Schools Impede Tax Exemptions

Property Tax Exemptions Saved Californians 30 Billion In 2018 Zillow Research

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Adu Summit 2021 How Adu And Prop 19 Will Affect Your Property Tax County Assessors Youtube

Scam Alert County Of Santa Clara California Facebook

Grand Jury Santa Clara County Schools Impede Tax Exemptions

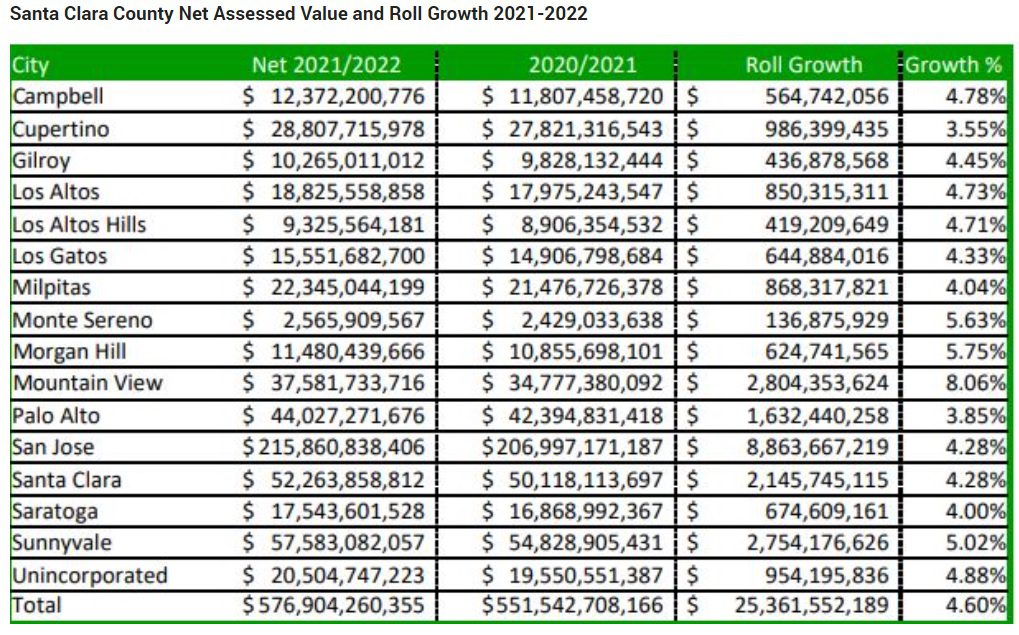

Santa Clara County Sees Increase In Value Of Taxable Properties San Jose Spotlight

Pride Panel Taxes And Home Ownership For Non Traditional

How Santa Clara County Will Help Seniors Paying Taxes They Don T Need To San Jose Spotlight

Santa Clara County Assessor Tells All Employees To Telework Says It S Not Related To Employee Testing Positive For Covid 19 The Silicon Valley Voice

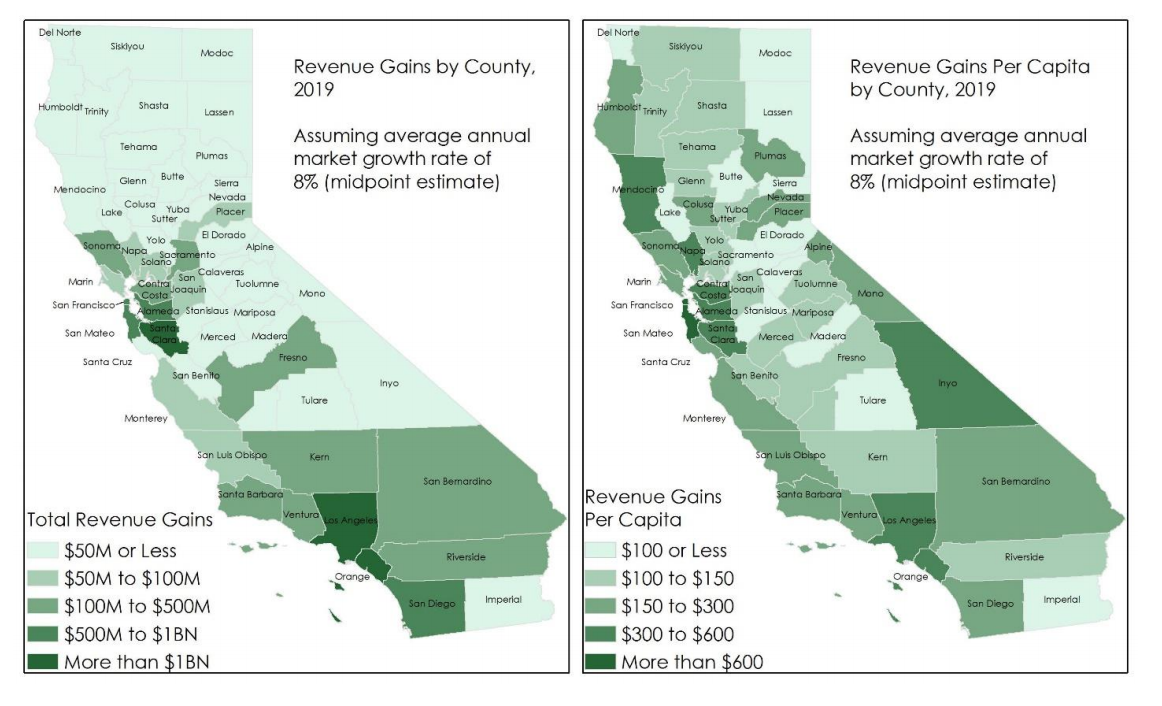

The Split Roll Initiative California S New Hope For Its Property Tax Loophole Berkeley Political Review

Property Tax Email Notification Department Of Tax And Collections County Of Santa Clara